Help your teen build confidence with money — now and for life.

In this 30-60 minute 1:1 Zoom session, I'll help your child or teen learn how to make, manage, and plan their money in a way that feels fun, empowering, and practical.

Each session is personalized based on their age, interests, and what they’d like to learn about, so I'll meet them right where they’re at.

The first session usually starts with creating a simple income and saving plan — helping them figure out how to cover their spending and start setting money aside for something they’re excited about.

From there, future sessions can explore topics like:

💡 Setting up savings “buckets” and learning how to specifically allocate their income

💡 Starting a savvy side hustle to earn more than minimum wage — with flexibility and better pay for their time OR if they don't want to do a side hustle - become employed from someone else

💡 Give them the tools to stand out and get hired for strong, stable roles in any economy.

💡 Planning to buy their own vehicle in cash

💡 Saving & planning to graduate post secondary school debt-free (if they plan to go to school)

💡 Learning how to invest as a teen (once steady income is in place)

They’ll learn how to practice delayed gratification, a skill that research shows is one of the best indicators of success later in life. In a world of instant spending and digital overconsumption, this helps them develop patience, discipline, and confidence around money — all while still having fun with it.

Why I Do This

This is my passion project.

Normally, it costs $400+/hour to work with me privately on financial coaching for adults. But I offer these sessions for just $50 for 30–60 minutes because I believe helping teens learn about money early changes the entire trajectory of their future.

When young people learn how to earn, save, and plan with confidence, they become adults who are less stressed, more secure, and free to create the life they want.

And let’s be honest — sometimes it’s just easier for teens to listen to someone else and really take it in.

Why Parents Trust Me

By age 26, I had saved and invested $250,000 of my own money.

By 31, I had enough invested to retire on more than $1 million, but I still choose to keep investing — to build even more financial stability, to have options like retiring early, and to be able to help more people financially.

Over the years, I’ve helped 500+ clients pay off millions in debt, build strong savings, and completely transform their relationship with money.

This session isn’t just "financial knowledge" — it’s a hands-on strategy session where your teen builds real money skills they’ll use for life.

It’s an investment in your teen’s lifelong trajectory and their financial confidence.

How It Works

1️⃣ Purchase the session for your teen.

2️⃣ You’ll receive a link to book a time slot in my schedule.

3️⃣ You’ll also receive a link to the Teen Intake Form, where your teen can quickly share things like:

- Their age and where they live

- Their interests and hobbies

- Whether they’re earning money currently

- What they’re saving for or want to learn

- Any money questions they have

(It only takes 5–7 minutes to complete.)

What’s Included:

✅ 30–60 minute 1:1 Zoom session with myself

✅ A personalized money plan your teen can start using right away — plus powerful, smart (easy to use) tools I’ve built to help them actually follow through.

✅ Follow-up resources or next steps based on their goals

Bonus for Every Teen

Every teen who books a Smart Money Kickstart session will also get exclusive access to my Career Interview Rolodex — featuring 80+ real career submissions from professionals across Canada.

It includes salary transparency, education paths and insider advice — with many six-figure careers represented.

This insider resource helps teens explore realistic, well-paying career options before spending thousands on post-secondary, giving them a huge head start in making confident, informed decisions about their future.

The Most Impactful $50-$150 You’ll Ever Spend on Your Teen’s Future

For just $50–$150 (typically 1–3 sessions), I’ll help your teen:

✅ Build a plan to start earning their own money — often well above minimum wage

✅ Learn how to cover more of their own costs (like a car, insurance, gas, school, or the things they ask for)

✅ Gain financial confidence while the stakes are still low at home

✅ Build the foundation for lifelong money skills and independence

Parents often spend hundreds or even thousands every year on sports, lessons, and extracurriculars — but very few investments will shape your teen’s lifelong financial confidence like this one.

So, ask yourself:

👉 Is $150 worth it to help your teen learn how to make money, manage it wisely, and avoid future financial stress?

Because this isn’t just about learning how money works — it’s about giving them the skills and mindset to build a financially secure and confident life.

Common Questions Parents Ask

Do I have to be on the call with my teen?

Nope! You’re welcome to join if you’d like, but it’s totally fine for them to do the session on their own. I actually find most teens open up and engage even more when they have a bit of independence.

How long is the session?

Each session runs about 30–60 minutes, depending on your teens attention span, focus and how many questions they have

What if my teen doesn’t have a job yet?

No problem at all — we’ll start with ideas for earning money, finding flexible ways to make income, and building healthy money habits before they even start earning regularly.

What if my teen already has a job or savings?

Perfect! We’ll use what they’re already earning to create a personalized plan for saving, spending, and setting fun (and realistic) money goals.

Do you record the session?

Sessions aren’t recorded for privacy, but I summarize the key takeaways and action items in an follow-up email that includes links to their Google Doc of notes & their spreadsheet (teen cash flow).

Can I buy more than one session?

Absolutely! Many parents book additional sessions as their teen’s goals evolve — for example, saving for a car, planning for school, or learning to invest. You can even gift a session to nieces, nephews, or family friends. It’s one of the most valuable gifts you can give a young person.

What if we need to reschedule?

No worries — just email me at [email protected], and we’ll find a new time that works.

What does my teen need for the session?

Ideally a laptop or computer for Zoom (it’s easier to see the tools we’ll use), a notebook or paper, and an open mind! A phone call is totally fine if that’s all that’s available.

After you process your payment, there are no refunds.

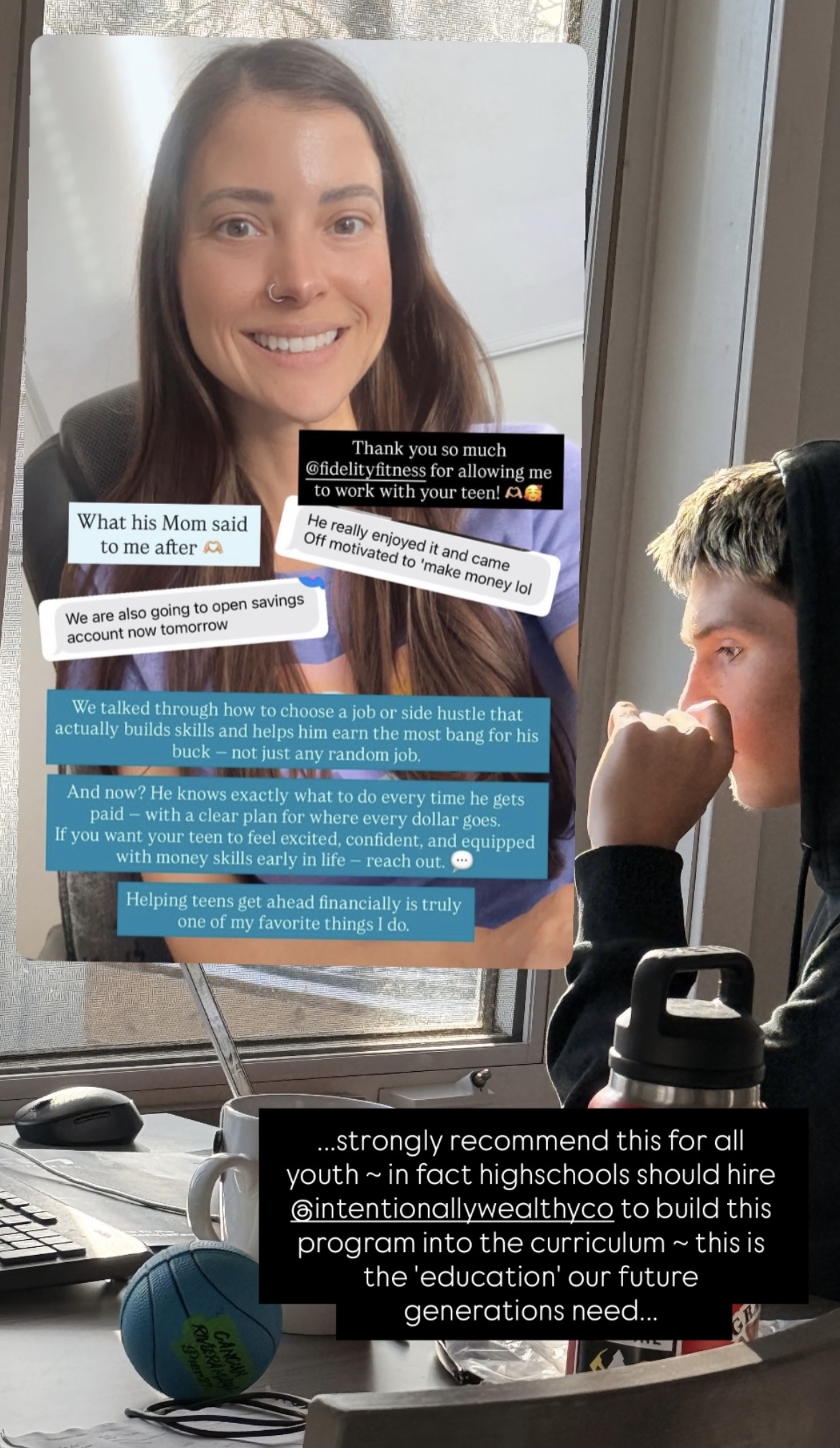

Here are a couple of messages I received after a Smart Money Kickstart session with a teen.

From a parent: “That was really impressive and thoughtful strategies you came up with for our kids. It's brilliant!”